I periodically post about valuable bonuses (often 50,000-100,000 miles) being offered when signing up for a credit card. A very common misconception of credit cards is that they ruin your credit. While that can be true if you don’t use credit wisely, they can actually improve your credit – and at the same time, be extremely profitable. So if you’re curious how credit cards affect your credit score, here’s my perspective.

First Things First

To begin, I am not a financial adviser, so I can’t guarantee any of the information below. I’m simply providing information about what I’ve learned through years and years of research, planning, and experience. You should consider your own personal situation and finances carefully, and consult a certified financial adviser with any questions. Now, with that being said, on to the good stuff…

My Experience

Over the past 10 years or so, I’ve applied (and been approved) for many credit cards offering huge sign up bonuses. I can’t say I’ve kept track of an exact number, but I’ve earned somewhere around a million miles – and that’s relatively low compared to some folks. Many others earn several hundred thousand miles year after year…and those folks, along with yours truly, still maintain excellent credit scores. While I didn’t apply for any cards within 2 years of applying for a mortgage last year (keep reading for why it was 2 years), prior to applying for the mortgage, I have held around 20 different credit cards over the years, and still had no trouble getting approved for the lowest mortgage rate available at the time.

I typically apply for 4-5 cards each year, while some of the real heavy hitters apply for 6 or more cards every 6 months. When I started looking into earning miles with credit cards, I started out very slowly, and this is exactly what I would recommend to other folks. I would only apply for 1 or 2 cards a year, and have slowly built up to more.

How Credit Cards Affect Credit Scores

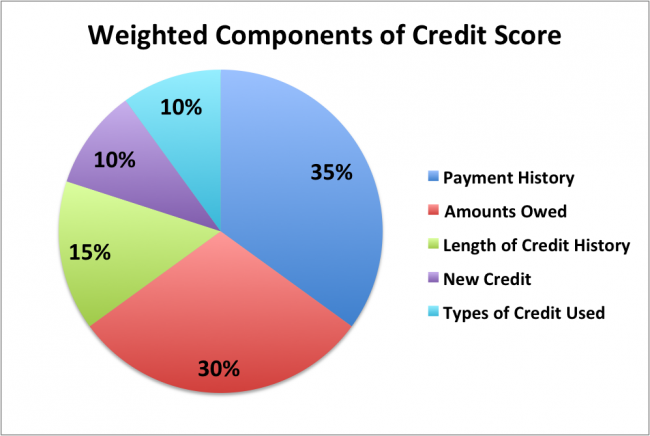

Overall, opening a new credit card will, at worst, have a minimal (2-5 point) impact on your credit score, and in reality, it can often increase your credit score. The numbers below come straight from the FICO website, and as you can see, by far the most important factor of a person’s credit score is simply their payment history. Paying credit cards and loans consistently is critical:

Applying for a new credit card does appear as a “pull” on your credit report (as the bank issuing the credit card wants to check to see if you’re responsible enough to be approved), so this pull can drop your score by a few points. The credit pull will show on your credit report for 2 years, but really only affects your score for the first 6 months or so – and this area of New Credit only makes up 10% of your overall credit score.

Clearly, there are many other factors that play into your overall score, such as your credit-to-debt ratio (shown above as Amounts Owed). If you currently have a single credit card with a $5,000 limit, and the current balance on that card is $1,000, you’re using 20% of your available credit. By opening an additional card, which might also have a $5,000 credit limit, your $1,000 balance now only represents 10% of your available credit being used. It makes logical sense that when your debt-to-credit ratio is high, you appear to be a riskier consumer (lowering your score)…while a lower ratio shows that you are responsible and a lower risk (increasing your score).

Diversity

In the purely financial world, you know the famous advice: diversify your investments. Well, in the travel mile/point world, it’s no different. Since not every airline flies to every city/country, and not every hotel chain has a hotel in every location, having a diverse portfolio of miles/points allows you to easily put together a trip. In addition, since airlines (and to a lesser degree, hotels) limit the number of seats (or rooms) available for mileage redemption. Even if multiple airlines fly to your desired destination, one might have availability and one might not. Or it may even be that one airline has availability for outbound leg of the trip, and another airline has availability for the return flights. For these reasons, it can be enormously helpful to have a diverse portfolio of points.

If you haven’t already read my post comparing Airline Mile/Points Programs with Generic Points Programs (like Capital One), it’s definitely worth your time if you want to earn and use miles efficiently.

Which Cards Should You Apply For?

When it comes to deciding which card is best for you, you really want to consider your goal for using your miles. Do you want to use them primarily for trips within the US, like from Bangor, ME to Burbank, CA? Are you dying to go to Brussels, Belgium? Or are Bangkok or Buenos Aires on your Bucket List? Some airlines are better for domestic flights, while some are better for flights to Asia or South America. There are no hard and fast rules that apply to every situation….availability can vary, but I’ve outlined some very general guidelines of airline award availability in this introductory post, which will help you start to identify what program you might want to consider for building up your mileage balance.

There are tons of cards available through many, many different programs. This post on FlyerTalk is regularly updated with the best available offers for just about every card out there.

Hopefully it helps clear up some of the misconceptions of how credit cards affect your credit score. If you have any questions or need any clarification, feel free to post a message below!